Nuggets of Wisdom

- Philippa Anselmino

- Apr 25, 2020

- 2 min read

Updated: Jul 18, 2020

From the greatest investors of our time, it is good to remind yourself of some of their takeaways from navigating the stock markets over the course of their career.

"Among the various propositions offered to you, if you invested in a very low cost index fund -- where you don't put the money in at one time, but average in over 10 years -- you'll do better than 90% of people who start investing at the same time." ~ Warren Buffet

For every $1 invested when Warren Buffett finished college in the 1950s, the stock market has produced $100

"Do not take yearly results too seriously. Instead, focus on four or five-year averages." ~ Warren Buffet

"Buy low and sell high. It’s pretty simple. The problem is knowing what’s low and what’s high." ~ Investor Jim Rogers

"Success in investing doesn't correlate with IQ ... what you need is the temperament to control the urges that get other people into trouble in investing." ~ Warren Buffet

"The stock market is a device for transferring money from the impatient to the patient." ~ Warren Buffett.

"Everyone has the brain power to make money in stocks. Not everyone has the stomach. If you are susceptible to selling everything in a panic, you ought to avoid stocks and ETFs altogether" ~ Peter Lynch

"When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients." ~ Warren Buffet

"The best chance to deploy capital is when things are going down." ~ Warren Buffet

"Be fearful when others are greedy and be greedy only when others are fearful." ~ Warren Buffet

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." ~ Warren Buffet

"If you like spending six to eight hours per week working on investments, do it. If you don't, then dollar-cost-average into index funds" ~ Warren Buffet

"In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497" ~ Warren Buffet

"You get recessions, you have stock market declines. If you don't understand that's going to happen, then you're not ready, you won't do well in the markets" ~ Peter Lynch

"When the time comes to buy, you won't want to" ~ Walter Deemer

"Far more money has been lost for investors preparing for corrections or trying to anticipate corrections, than has been lost in corrections themselves" ~ Peter Lynch

"Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas." ~ Paul Samuelson

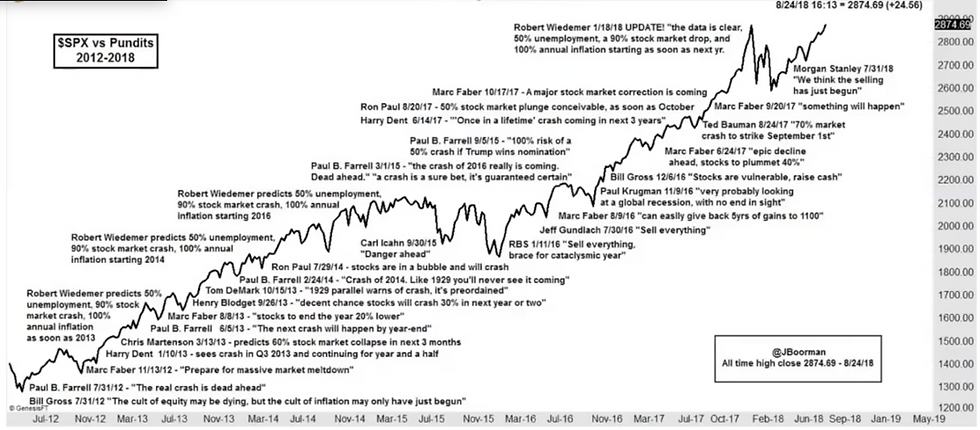

These are generally accepted wisdoms plucked from the greatest investors of the 20th/21st century. but it is also important who you aren't listening to, and that is usually the pundits on the news. See below for the gains you would have missed, listening to scare mongers on the news. In fact, it can be a good contrarian indicator.

Comments